Contents:

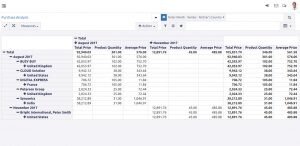

If so, where are you specifying the https://bookkeeping-reviews.com/ to account for each payment? However, when I sit down to do the Bank Reconciliation my bank balance first of all is negative and the Deposits versus Credits sections is off by right around the total of Undeposited funds. The transactions are imported as “paid sales receipt” (PDG tech support’s words). On “customer deposits”, they may be just what they say they are, ie, deposits in advance of delivery of a product or service. When a sale takes place, the liability would be relieved and the funds applied as a payment for the sale.

In our company we receive some revenue from investment firms prior to any invoicing. We set up a Master account for these funds as they come in and sub-accounts for each client that we receive these for. Once the work is done we create an invoice for the full amount of billing. Billing is noted to individual employees in order to track how much each person is billing on a monthly/annual basis. When you delete a deposit, you are removing the transaction that was posted as part of step #2.

ReliaBills also sends updates and creates a streamlined process for your receivables. That way, you can send and accept payments without unnecessary confusion and frustration. The only time you’ll have to pay is when you want to upgrade your account to PLUS and get paid even faster. Afterward, make all the necessary changes and select ‘Refresh‘ to save changes. This process is how you can transfer undeposited funds to your bank from Quickbooks.

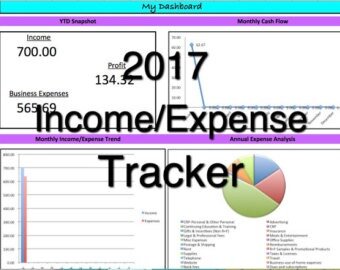

Recording of credit card transactions with undeposited funds

If so, offset the Undeposited Funds against Sales or Revenue. If there is a balance in undeposited funds then those transaction would not be “cleared”. However, in this file, there is a debit balance remaining of around $3k in undeposited funds which would lead me to believe there may be some missing deposits at quick glance. Understanding this final portion is very important because your bank statement will show you this total amount of the deposit, as opposed to the varying amount of the different checks. For example, If you want to add in a reimbursement check or a check from a utility company, this is the place to do it. You can go in to this section , type in the name of the check sender and choose to add them as a customer, vendor, or employee.

Here’s how to avoid the Undeposited Funds TRAP. Every QuickBooks Online file has an undeposited funds account that is generated automatically when the file is opened. This account tends to create a lot of confusion with new and seasoned users alike. To fix this, the easiest approach is to delete the deposit and re-enter the transaction correctly (ie, record a customer payment to relieve the A/R and turn that payment into a deposit). I have multiple sources of income being tracked through QB and I’d like to track from where they come. If my deposits are going through undeposited funds I can’t differentiate the Income category right? I am a sole practitioner using Timeslips Tal Pro 2014 to link with QB Pro 2013.

QuickBooks Online® Basics: Bank Deposits & Undeposited Funds (Series 2, Lesson

If you print a balance sheet, your bank balance should be accurate and your Undeposited Funds account should reflect your cash on hand. The first step is to make sure you have the undeposited funds preference enabled. Once on the Make Deposits window, you can click the Payments button to show any payments available to deposit, but this should appear if you have payments. Remember QuickBooks follows a set of activities called a flow.

Thus, this deputy and xero integration acts as a buffer to hold the amount until you further deposit the amount in the bank account and the QB register tallies its figure with that on the bank statement. If you use ePayments, a separate deposit should be entered for cash/check and then another for the credit card/bank account payments. EPayments have a settlement time and do not hit the bank at the same time a physical deposit taken to the bank does. The goal is to have each deposit made in QuickBooks be the same as what you will see on your bank statement on any given day. But clearly, these items from 2017, didn't go into the checking account. And what we're going to do is we're just going to make a fake bank account just so we can clear out this function and the undeposited funds.

Accounts Receivable: Undeposited Funds Account

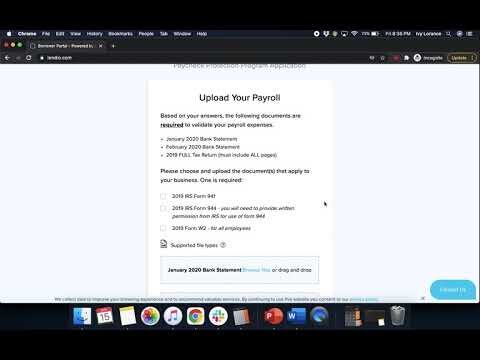

This step should parallel the physical deposit you take to the bank. Select all the payments you will include in the deposit, making sure the amount you record in QuickBooks Online matches the amount on your bank deposit slip. Also, be sure you are posting the deposit to the correct account — in this case, checking — and that the date on the transaction is the date you will take the deposit to the bank.

In QuickBooks Online, you cannot select a default “deposit to” account. However, the bank account you select on a transaction will come up the next time you create the same type of transaction. Posting payments as either sales receipts or paid invoices and linking them to undeposited funds is best way to manage the Intuit QB GL, transaction journal, and reports. You can send invoices, record sales receipts, receive payments, and deposit them into Undeposited Funds within QuickBooks. Then match those with records with your bank as needed. Your client chose to pay their bill using multiple payment methods.

However, Extra Undeposited Money can be an Indication that the Business is Not in Good Health. Choose all the Payments that you wish to Clean from the Particular Undeposited Fund Account and then Save the given Page. Read on to understand how these two methods function. Keep up to date with our newsletters and posts filled with useful tips to help your small business succeed.

How to move funds from undeposited funds in Microsoft Dynamics 365 Business Central

Gentle Frog, LLC does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Gentle Frog, LLC does not warrant that the material contained herein will continue to be accurate, nor that it is completely free of errors when published. Readers and viewers should verify statements before relying on them. Undeposited Funds is a special holding account within QuickBooks.

Clerk of southern Iowa city misused $57,000 in city funds, audit found - Des Moines Register

Clerk of southern Iowa city misused $57,000 in city funds, audit found.

Posted: Thu, 02 Dec 2021 08:00:00 GMT [source]

To navigate to the bank feed click Banking in the left-side menu then Banking again. Make your note in the Memo field to indicate a correction, and enter “-125.00” in the amount column. In the top right corner of the screen, click on the plus sign icon and choose "Bank Deposit" under the "Other" category.

If that happens, the only solution is to make the deposit as you normally would using the undeposited funds account and delete the duplicate deposit recorded by online banking. That’s because the transactions did post to the correct expense account. However, you won’t be able to reconcile your credit card account and, if you use cash basis accounting, your financial statements will be wrong. You can determine if it is worth the time to adjust these transactions to the ideal method I described above.

If the account was listed before the bank account it might make more sense to folks. If nothing else, don't force the account on folks OR let them assign which GL account as to use as the pass through account. Learn about the Undeposited Funds account and how to combine multiple payments together in QuickBooks. Under your Chart of Accounts, create a new checking bank account and call it something that sounds fake to not confuse it with a real account.

Creating separate undeposited Fund accounts for different payment methods allows the user to reconcile incoming payments properly. Separate undeposited fund accounts for different locations is also recommended. Complete the following steps to configure undeposited fund accounts. If you have old transactions in your undeposited funds, this may have happened from a data transfer from QuickBooks Desktop, or another accounting program the quick way may be an option. If you opt for this method be sure to let your accountant know what you are doing.

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

The scoring formulas take into account multiple data points for each financial product and service. Billie Anne has been a bookkeeper since before the turn of the century. She is a QuickBooks Online ProAdvisor, LivePlan Expert Advisor, FreshBooks Certified Partner and a Mastery Level Certified Profit First Professional. She is also a guide for the Profit First Professionals organization.

Use the “Record Deposits” window to select all payments in the undeposited funds account. Yet when I do my Sales Receipt, all payments are going into my bank account…I can’t get anything to go to undeposited funds, regardless of system selection. Since QB doesn’t allow a typical user to see what are the accounts mapped to a special account type, I recommend you record this info in the account description. You can figure out which account is mapped to a special account type by observing how that account behaves. For example, if you have the Undeposited Funds preference enabled, a customer payment will first go in the account mapped to that special account type. Hey Chief, you seem like the most knowledgeable person in the realm of undeposited funds account I’ve come across.